Offer in Compromise – Income and Expenses

Step One of our five step process to tax resolution is Assets, which we covered in the previous blog. Step Two is Income and Expenses which we will cover in this blog. Recall that the amount of your offer to the IRS will be a combination of assets and discretionary income.

Income – What is the difference between gross income and net income?

Gross Income. This is the total amount of all your income before you have anything deducted for taxes or payments of any kind. If you have a salary of $100,000 per year you have gross income of $100,000. If, in addition to the $100,000 of salary, you have $10,000 of dividend income your total gross income will be, you guessed it, $110,000.

Net Income. The following image may help you to understand what net income is. Imagine that your gross income is falling from the sky and you only have a fishing net to catch a portion of the total. The amount that you are able to collect in the net is, that’s right, net income, or part of your Gross income. Your net income is the amount you receive after subtracting all of your deductions for taxes, charitable contributions, 401(k), etc.

The critical issue with income, when you file an Offer in Compromise, is that it does not matter if the income is taxable or non-taxable. All of your income from all sources is entered in box D, section seven, of the IRS Form 433-A (OIC).

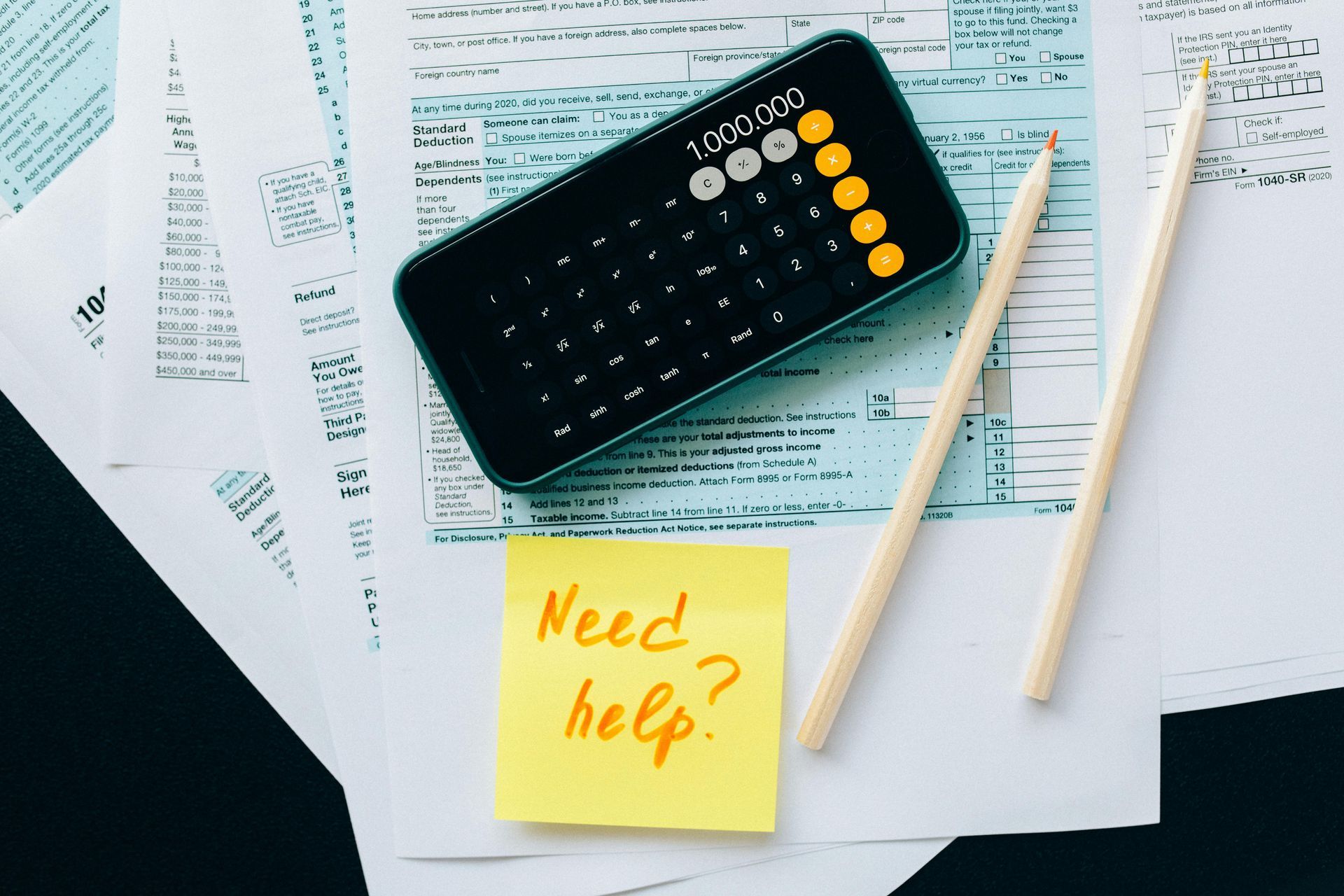

Expenses

The odds of you settling your tax debt are increased when you calculate your discretionary income by using the “Allowable Expenses” that are listed in the IRS’s National and Local Standards. This is an area where a lot of mistakes are made when the 433-A (OIC) is filled out. To increase your chances at being successful you will need to follow the ever-changing National and Local Standards. The IRS links below will give you up to date information on the four different kinds of National and Local Standards:

- National Standards: Food, Clothing and Other Items

- National Standards: Out-of-Pocket Healthcare Expenses

- Local Standards: Housing and Utilities

- Local Standards: Transportation

One deduction that is not mentioned in the IRS booklets is an additional $200 per month for a car that is either 6 years old or has more than 75,000 miles on it. Make sure to take this deduction if it fits. Each year the IRS deductions change so it is great to work with a professional so you don’t miss any deductions.

The amount of your offer

At this point you need to subtract your “Allowable Expenses” from your Gross Income to determine your discretionary income. This discretionary income will be added to the equity in your assets to determine the amount of your offer to the IRS. Here’s how it is done. If you can pay your offer amount in five months or less then multiply your discretionary income by 12 and add that to your equity in assets. If you need 24 months to pay then multiply your discretionary income by 24 and add that to the equity in your assets. Look on page 7 Section 8 of IRS Form 433-A (OIC) for info on how to calculate this.

You are doing quite well on your journey to resolve your tax debt situation. In our next blog we will discuss steps three and four: Becoming current with all tax return filings and estimates, and how to organize your documents and prove every number

Please complete the form below and we'll set up an appointment for you.