Offer In Compromise – Assets

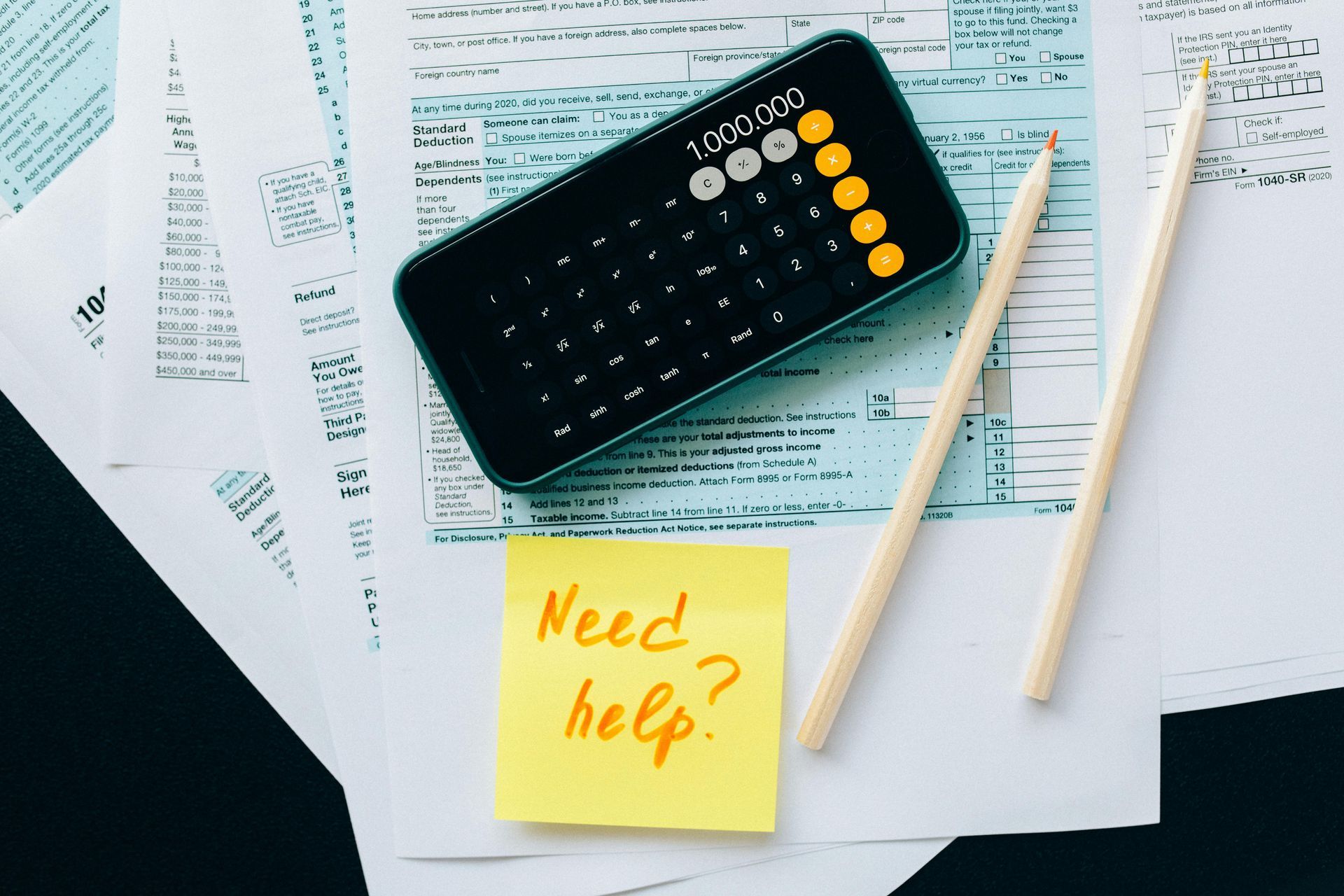

In order to solve your tax problems with an OIC you will need to fill out two IRS forms, Form 656, and Form 433-A (OIC). The assets will be entered in Section Three of the IRS Form 433-A (OIC).

What is an Asset and what does it mean to have Equity in an Asset?

Assets are what you own. They can be either a purchase or a gift from someone. The most important thing about assets as they relate to tax relief is the equity in an asset. Equity is the difference between how much your asset is worth and how much you owe on the asset. In other words equity is the value of the asset minus the debt you owe. If you buy a car with a value of $15,000 and you owe $10,000 the equity is, you guessed it, $5,000.

If you buy an asset for $5,000 and pay cash, of course, you have no debt. In this scenario the equity equals the full value of the asset because there is no debt. Remember the basic formula: Value – Debt = Equity. $5,000 – $0.00 = $5,000. The cash in your checking account has no debt so, it too, has an equity equal to the value of the cash.

What about gifts?

If your Aunt Bertha gives you a diamond ring valued at $50,000 how much debt do you have? Of course, $0.00. The value, $50,000 minus the debt, $0, means that you have $50,000 of equity in your ring because you have no debt. Again, equity in an asset is the value minus the debt.

Equity and Tax Relief

When you are trying to get tax relief by filing an OIC the IRS will look at the equity in your assets as their money. It does not matter to them where you got the asset. (There is some consideration for business assets but that will be discussed in another blog). The amount of money that you propose in your Offer in Compromise will include two parts, a portion of the equity you have in your assets and discretionary income. (covered in a later blog.)

In order to solve your tax problems with an OIC you will need to fill out two IRS forms, Form 656, and Form 433-A (OIC). The assets will be entered in Section Three of the IRS Form 433-A (OIC). You don’t need to include the entire amount of equity in each of your assets when you figure the amount of your offer. Let me show you what I mean. Please take a look at Section Three, page two of the IRS Form 433-A (OIC). On line 2(a) notice that the total amount of the asset is to be multiplied by 0.8. This means that you only need to include 80% of the value of that asset. The percentages vary from 70% to 80% just pay attention to the particular line and the amount needed.

You are on your way to resolving your IRS problems by filing an OIC. Assets are one-half of the offer. The other half of the offer is your discretionary income which is income minus expenses. That’s what we will cover in the next blog post – expenses.

Please complete the form below and we'll set up an appointment for you.